Accounts receivable turnover ratio: formula, decrease and increase

Currently, any educated personknows that every firm, organization or enterprise operates with a variety of economic and banking terms, which, in turn, can be quite specific for a common man in the street. The following article will help you understand one of these definitions. In particular, to thoroughly study what is the turnover ratio of accounts payable.

Terminology

First, let's see what constitutesconcept of turnover. A similar term is a financial indicator that takes into account the intensity of the use of any particular means, assets or liabilities. In other words, it allows you to calculate the speed of one cycle. Such a factor can be considered one of the parameters of business and economic activity of the enterprise in question. In turn, the turnover ratio of accounts payable shows how much money the company is obliged to reimburse to the creditor organization by the appointed time, as well as the amount that will be required to make all the necessary purchases. Thus, we can conclude that the ratio of turnover of accounts payable allows you to determine the number of cycles for full payments on the accounts presented. It should also be taken into account that the supplier of any product may also act as a creditor.

Calculation of indicator

The ratio of turnover of accounts payabledebt (formula) is as follows: this is the ratio of the value of sold products to the average value of loan commitments. The term cost price can be understood as the total cost of production of a particular product for the year. In turn, the average debt is defined as the sum of the values of the required indicators at the beginning and end of the period under review, divided in half. Nevertheless, it is possible and a more detailed detailed calculation and study of all the changes taking place.

The second method

A fairly widespreadone option for calculating such an indicator as the ratio of the turnover of accounts payable. Thanks to this method, you can determine the average number of days during which the organization in question will pay all of its debts. A similar variant of the parameter is called the period of collection of accounts payable. Its calculation is made by the following formula: the ratio of the average debt to the cost of sales, multiplied by the number of days in the year, namely 365 days.

However, it should be borne in mind that whenanalysis based on reports for any other periods, it is necessary to adjust the value of the product accordingly. As a result of such calculations it is possible to find out the average number of days during which the services of suppliers are considered unpaid.

Fluctuating values: increase

When examining the results ofor other enterprise, it is necessary to take into account that the turnover ratio of accounts payable largely depends on the scale of production, as well as on the scope and industry of activity. For example, for organizations that carry out cash loans, the highest value of the indicator in question is most preferable.

However, for companies that are provided withsuch help, conditions that allow to have a reduced value of the sought parameter are considered more favorable. This circumstance makes it possible to have some margin in the form of a balance of unpaid obligations as a source of free replenishment of financial accounts for the performance of normal work. Increase in the ratio of turnover of accounts payable leads to the most rapid mutual settlement with all suppliers. This type of obligation is a short-term free loan, therefore, the longer the repayment periods are delayed, the more favorable for the company is the situation, since it provides the opportunity to use other people's finances. If the ratio of the turnover of accounts payable increased, then we can talk about some improvement in the state of the payment capacity of the organization in relation to suppliers of raw materials, products and goods, as well as to extrabudgetary, budgetary funds and employees of the company.

Variations in the quantities: decrease

A decrease in the ratio of the turnover of accounts payable may lead to some of the features described below.

1. Difficulties with payments on presented accounts.

2. Possible reorganization of relationships with suppliers to ensure a more profitable payout schedule. Thus, if the ratio of the turnover of accounts payable decreased, then we can speak of both benefits for the enterprise on the one hand, and about the alleged loss of reputation in the other.

Analysis

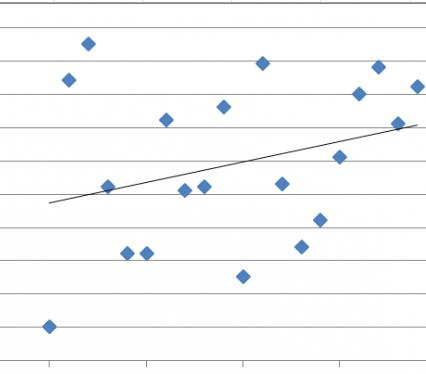

Of course, when considering turnoveraccounts payable it is also necessary to take into account the factor of the turnover of receivables, since if you study only one of the two presented values, you can lose important data. This, in turn, can lead to an unfavorable situation for the organization as a whole, when the first of the above indicators significantly exceeds the second. In addition, from the foregoing, it can be concluded that the high value of creditor obligations contributes to a decrease in both the solvency and the overall financial stability of the enterprise.

Benefit of the organization

If we take into account the share of the creditordebt, then you can calculate the profit of the enterprise in a fairly simple way. The benefit lies in the magnitude of the difference in interest rates on loans (in general, it is assumed to be equal to the amount of obligations of this type) for the period of the stay of funds in the account of the organization and the amount of this debt itself. In other words, it can be said that the profit of the company in question is determined by the amount of financial resources saved due to the fact that there is no need to pay interest to banks for loans issued from them.

The positive factor

It can be assumed that the turnover ratiois a quantity that is inversely proportional to the value of the velocity of revolution. Thus, it turns out that the higher the cyclicity coefficient, the less time it takes for a complete revolution. Consequently, if the value of the turnover of receivables is higher than the value of creditor, then they consider that the conditions for further development of the economic and entrepreneurial activity of the enterprise are positive and favorable.

Conclusion

From all that has been said before, we can draw the following conclusions.

1. The value of the ratio of turnover of accounts payable depends on both the scope of the organization and its scale.

2. For companies that provide loans, the highest indicator is most preferable, and for organizations that require such payments, it is advantageous, on the contrary, that the coefficient is lower.

3. In the process of analysis, one should take into account not only the turnover of accounts payable, but also the treatment of receivables.

4. Debt obligations include not only settlements on loans, but also labor remuneration for employees of the organization, payments to contractors, taxes, fees, relationships with extrabudgetary and budgetary funds.

5. For the favorable development of the entrepreneurial and economic activities of the enterprise, it is necessary that the loan turnover ratio largely exceed the value of the similar indicator for accounts receivable.

</ p>