Gold coins of the Savings Bank of Russia

In connection with the volatile situation in the economyRussia's most wanted and reliable investment tool today are the gold coins of Sberbank. In periods of financial crises, assets made from precious metal become the most reliable and less risky ones. It can be noted that buying investment banknotes is an excellent opportunity to diversify risks in the portfolio.

What is investment coins?

Investment gold coins of Sberbankare in demand for a reason. The popularity of the asset is due to a complex of parameters. Gold monetary units are a unique commodity that can not only be easily purchased, but also easily sold. Metal accounts in this aspect do not even go into comparison. Coins are easily stored, if necessary transported. During the crisis, precious metals increase in price, therefore, the value of the coins themselves also grows. Coins can be timed to the category of eternal values, as the longer they are stored, the higher their value will be. Investing in monetary units is more profitable for a long period of time - at least 10-15 years.

A bit of history

Gold in the past has always been thecommon means for mutual settlements. The ingots were used to pay for various kinds of goods and services. Since 1983, the idea of coining gold coins in honor of an important event in the royal families or in history has been actively supported by most people. Despite the fact that the first coins from the "solar metal" did not belong to the category of means of payment, they were of high value and were considered memorable signs. Modern gold coins of the Savings Bank have no artistic value, but they are recognized as an excellent tool for investment. For the first time precious metal for investment began to be used in the 20th century. The first batch of gold banknotes was admitted to the USSR in the 1970s, then in honor of the Olympics organized in the 1980s. The action was held only once, and people who were lucky enough to buy coins in 1978, today are more than secured.

Coinage today

After the first issue of gold coins in the territorymodern Russia in this direction was a lull. The resumption of the issue of gold currency began in the period of perestroika. Money marks were made not only from gold and silver, but also from palladium and platinum. Today, only the main precious metals are used in coinage. Gold coins of the Savings Bank are not the only thing that the financial institution offers today. In the banking catalogs you can find a huge number of foreign coins, which are not only more expensive, but also incredibly high-quality. In recent decades, the issue of assets involved in Russian mints: Moscow and St. Petersburg.

The most bought coins in the Savings Bank

In the directory of the Savings Bank you can find numerousthe number of coins made of gold and silver, products made of palladium and platinum have not been produced since 1995. Nevertheless, investors adhere to their tastes and prefer only certain series of coins:

- The coin "George the Victorious", (Sberbank produces it with a weight of 7.8 grams) has a denomination of 50 rubles. At the end of April 2015, the asset's carrying value is 16,671.71 rubles.

- Coins of the series "Signs of the Zodiac" with a weight of 7.8 grams. Gold is used for coining 999 tests. The denomination of the banknote is 25 rubles. The average market value of the coin is from 13 thousand rubles and above. In Sberbank are available analogues of an asset from silver, which are in demand as a gift.

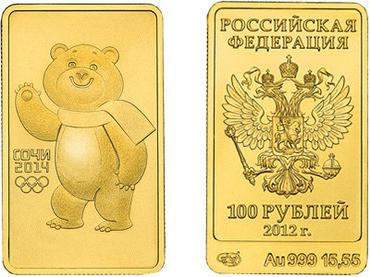

- Investment gold coins are popularSberbank, chased in the honor of the 2014 Olympics in Sochi. Weight of coins is 7.8 grams, and the price starts from 20 thousand rubles. Sale of the asset is carried out together with a specialized case. The denomination of the money sign is 50 rubles.

Special admirers of gold investments canpurchase and specialized coins from the Sochi 2014 series, whose weight is 155.5 grams. The price of one unit of the asset may be about 395 thousand rubles.

Types of gold coins

Sberbank of Russia gold coins produces twotypes. These are memorable signs and investment. The main difference between the two types of monetary units is not only as a coinage, but also depends on the complexity of the work. Run in many parameters determines not only the capabilities of the asset itself, but also the purpose of its acquisition. The quality of minting commemorative signs is much higher than that of investment. Coins are more beautiful, have a bright characteristic luster. Touching them with your fingers is not worth it, since there may be fatty traces, which are problematic to withdraw. The gold coin "George Pobedonosets" (Sberbank) is not so sensitive to touch.

Memorable gold assets

Memorable banknotes are quite complex inperformance. They are issued in very limited editions. Characterized by a unique design of the reverse and quite often performed with a non-standard form. There are rectangular, triangular products and coins in the form of a heart. The surface of the currency is predominantly mirrored, there is a complex pattern and precise fine details. Coins are of great value not so much for investors as for numismatists. When buying them, it is customary to charge VAT. The tax is not taken into account when the memorable gold and silver coins of the Savings Bank return to the financial institution. For the accumulation of capital, this category of products is not very beneficial.

Investment coins

Investment coins of gold with easecan provide material well-being for many years. They are produced in wide print runs and have a simple design. The design of the reverse does not differ intricately. The surface of the products can be both matte and shiny, the pattern may not be characterized by high accuracy. Mechanical damages are allowed. Gold investment coins of Sberbank of Russia are not taxed. Coins with the status of "investment" are a kind of analogue of gold options, measured ingots, futures and depersonalized metal accounts. Coins are available for purchase not only in the Savings Bank, but also from individuals, commercial financial institutions or private companies. When planning an asset purchase, it is worth counting on the fact that its value will be close to the value of precious metal on the world market. Cooperate better with trusted institutions, as fraud is very common.

</ p>